IPP Financial Advisory Private Limited

Kyra Lau

A one-stop platform for all your financial needs, with your most trusted advisor

My Services

Providing a wide range of services to help you reach your financial goals

Insurance planning

Have you asked yourself these questions: Are you spending too much on your coverage? When was the last time you had your consolidated portfolio reviewed?

How much has it costed you?

...Read more

Investment planning

Are you working hard for your money? Or is your money working hard for you?

Are you managing your own portfolio or is your portfolio professionally managed? Introducing Eagle Eye, our professionally managed portfolio which does a great job at maximising returns yet minimising volitality

...Read more

Retirement Planning

Is your CPF life annuity stream of income enough for your retirement? Do you have enough asset classes in place?

Some reasons why retirement planning is important include increased life expectancy due to advanced medical improvements. Hence, early planning means more time for your investments to enjoy the effects of compounding and ensures that you can retire comfortably without stress in your golden years ...Read More

Estate Planning

Will Writing

Why is financial planning so important?

"If you fail to plan, you are planning to fail"

- Benjamin Franklin

Serving clients from all walks of life, I have experience in evaluating and selecting the best policies out in the market tailored to the needs of my clients.

Many do not know where to start and how to start their financial planning journey and they often think that insurance is not necessary or a waste of money and that investment is only for people with a high risk appetite. However, there is a wide variety of insurance plans and investment portfolios that cater to different people depending on an their financial goals.

- This is the step-by-step financial planning process I go through with all my clients:

- Review - Reviewing the current policies or investment plans that you own

- Understand - Understanding your financial goals

- Analyse - Comparing the different plans offered by various companies

-

Advise - Providing you with my professional advise

About Me

I am a Licensed Financial Advisor and professional estate planner at IPPFA with a Bachelor’s Degree in Business Administration (B.B.A. Finance).

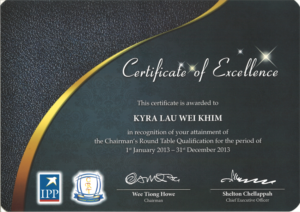

Additionally, I am a recipient of the IPPFA’s Chairman’s Round Table Qualification (CRT) Certificate of Excellence award in 2013, the highest award that recognizes the top advisors in the company and have been receiving the Certificate of Achievement from IPPFA over the past few years.

![]()

![]()

Companies we work with

We work with these companies to provide you a wide variety of financial products and services to choose from

More than 73 companies including Aberdeen, J.P. Morgan, Phillip Capital Management, Allianz Global Investors Singapore and many more to provide strategy and holistic solutions for wealth accumulation

Consisting of life insurers and general insurers like AIA, Tokio Marine, NTUC Income, Manulife and many more to provide solutions to protect your health, family, wealth and assets.

Partnering with AXA, NTUC Income and many more companies to provide employee benefits for business owners

We partner with banks like Citibank, DBS, OCBC and many more for our clients to finance or refinance their property loans

Partnering with Rockwills to implement solutions in assisting our clients in Estate and Business succession planning to transfer their wealth.

Testimonials

What do My Clients Say?

Newsletter Snippets

Subscribe to our Weekly Market Update

Subscribing to our iFAST Weekly Market Update is easy and convenient, just click on Subscribe below and you will be added to an exclusive Whatsapp broadcast list where you will receive updates about the global stock market every week

Frequently Asked Questions (FAQ)

Want to clarify your doubts about any insurance or investment-related information mentioned above?

Insurance

- Life insurance

- Endowment

- Health insurance

- Education

- Critical Illness Plans

- Personal Accident Plans

- Investment-Linked Plans (ILPs)

- Travel insurance

- Home insurance

- Car insurance

Basic insurance coverage includes enough life insurance, critical illness (CI) coverage, total permanent disability (TPD) coverage.

Additional coverage to prepare for a financially comfortable life in the future can include Hospital and Surgical (H&S) plans, Personal Accident (PA) plans, and Endowment plans.

I analyse various types of insurance plans and coverage from different insurance companies based on your financial goals and make distinct comparisons in terms of their premiums, coverage and plan term for you to decide what is best for yourself

Investment

Eagle Eye is an IPP Financial Advisers Pte Ltd in-house proprietary Model Portfolio, reflecting the investment views and strategy of IPPFA’s Investment Team.

It follows a fund-of-funds concept, where the underlying portfolio consists of mutual funds.

IPPFA’s Investment Team employs a systematic approach in developing its investment strategy and utilises proprietary FTQ methodology to determine asset allocation.

Fundamental

We assess the economic conditions and market sentiments and perform a fundamental valuation of all major markets.

Technical

We use our proprietary technical indicators and other relevant technical analysis tools to identify price patterns and market trends.

Quantitative

We anticipate stock market movements through our proprietary Statistical Research Model.

- Stocks

- Exchange-Traded Funds (ETFs)

- Options

- Bonds

- Indexes

- Mutual Funds